10 Simple Techniques For Loans

Wiki Article

Quick Payday Loans Of 2022 Fundamentals Explained

Table of ContentsHow Quick Payday Loan can Save You Time, Stress, and Money.The Best Strategy To Use For Payday LoansThe smart Trick of Payday Loan That Nobody is DiscussingSome Known Facts About Payday Loans.

Your company could reject your demand, however it's worth a shot if it implies you can stay clear of paying inflated costs as well as passion to a payday lending institution. Asking a liked one for help could be a difficult conversation, but it's well worth it if you're able to prevent the extravagant rate of interest that includes a payday advance. Payday Loans.Ask your lending institution a whole lot of inquiries as well as be clear on the terms. Strategize a payment plan so you can settle the lending in a timely manner and also stay clear of coming to be bewildered by the included cost. If you comprehend what you're obtaining into as well as what you require to do to leave it, you'll repay your car loan a lot more promptly and minimize the effect of shocking passion rates and charges.

What ever the factor you require the loan, prior to you do anything, you need to recognize the pros and disadvantages of payday finances. Payday finances are small money loans that are given by brief term car loan lending institutions.

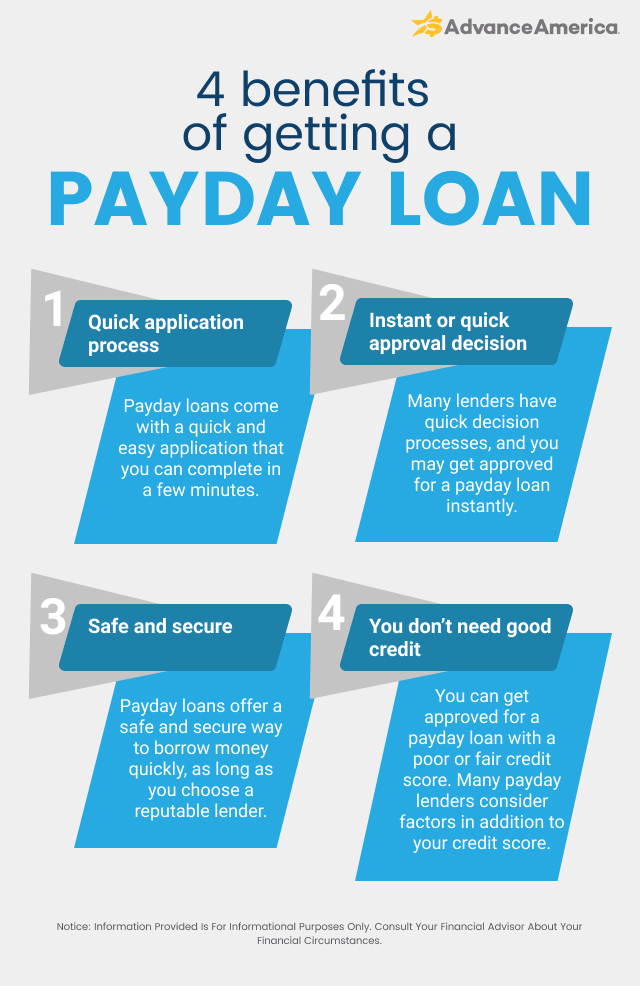

Below are the advantages that consumers are seeking out when using for payday advance. With these cash advance car loans, obtaining cash swiftly is a feature that payday advance have over its conventional rivals, that call for an application and then later on a check to send to your checking account. Both the authorization procedure and the cash may provide in much less than 24 hrs for some candidates.

Some Known Factual Statements About Loans

Pay stubs and proof of employment are more crucial to the approval of your application than your credit report. Nearly any individual with a constant work can look for a cash advance, after just responding to a handful of concerns. These car loan applications are also a lot more basic than conventional options, leaving room for the consumer to be as exclusive as they require to be concerning their funding.

While there are a number of pros and also cons of payday finances, on the internet lender access makes this alternative a genuine convenience for those that need money quickly. Some clients enjoy the personal privacy of the net lending institutions that only ask very little inquiries, review your earnings, and also deposit cash right into your account quickly after you have digitally authorized your agreement.

Indicators on Quick Payday Loans Of 2022 You Need To Know

Like all great money choices, there are worrying features that stabilize out those appealing benefits. As available as something like a cash advance is, it can be something that is too great to be real. Since of the consumers that these short-term financing lenders bring in, the disadvantages can be additional damaging to these consumers and their economic states (Quick Payday Loan).Some consumers find themselves with rate of interest price at half of the car loan, and even one hundred percent. By the time the lending is paid off, the quantity obtained and the rate of interest is an overall of twice the original finance or more. Because these prices are so raised, customers find themselves not able to make the complete payment when the following check comes, enhancing their financial obligation as well as straining themselves economically.

As an example, a few of these brief term funding lending institutions will certainly add a cost for clients that try to pay their financing off early to remove several of the interest. When the payday advance loan is contracted, they expect the payment based upon when someone is paid and also not previously in order to accumulate the rate of interest that top article will be accumulated.

If the cash advance is unable to be paid completely with the following check, and also the equilibrium pop over to this site needs to roll over, the customer can expect yet an additional cost that is comparable to a late cost, charging them more interest basically on the payday advance loan. This can be challenging for a household as well as prevent them from having the ability to be successful with a finance - Payday Loans.

Quick Payday Loan for Dummies

Several customers find these payment terms to be ruining to their funds and can be more of a concern than the requirement that created the first application for the car loan. Often consumers locate themselves unable to make their cash advance repayments and also pay their costs. They compromise their payment to the payday advance business with the hopes of making the repayment later on.

As soon as a debt collection agency obtains your financial debt, you can anticipate they will certainly call you frequently for repayment by means of phone as well as mail. Needs to the debt continue to remain, these debt collector might have the ability to garnish your earnings from your description incomes up until your unsettled financial debt is gathered. You can establish from the people mention guidelines - Payday Loans.

Report this wiki page